Entering the market must be carefully planned.

Once you have decided to establish a branch office, this step should be carefully considered. Legal and tax advisors should be involved from the very beginning to avoid potential risks and to save costs.

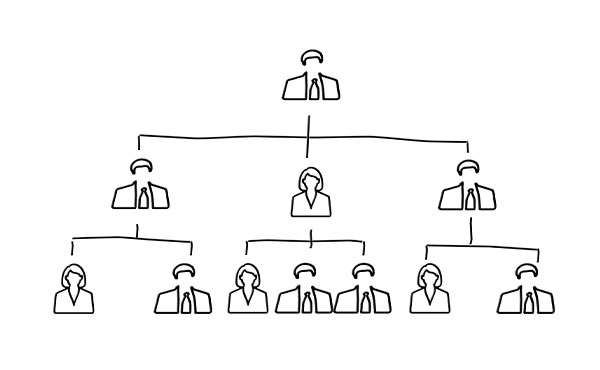

Regardless of the legal aspects, several additional organizational matters must also be addressed, such as the choice of legal form, management structure, registered business address, import regulations, personnel matters, and work permits for employees from abroad.

Below, we have compiled a brief overview of the most important issues, along with further information and guidance.

Incorporation of an LLC in Germany

Get to know the most widely used company form in Germany.

Residence and work permi

Without a work permit, an EU foreign employee cannot be hired.

EXPORT OR OWN BRANCH

Typically, the first step in entering the German market is import, either directly or through distributors. However, when it comes to establishing a branch office, success is directly dependent on the structuring of the business setup. This must be carefully considered.

PLANNED ACTIVITIES AND THE CHOICE OF LEGAL STRUCTURE

The choice of legal structure is closely related to the planned activities. If your branch office is intended solely for distributing business cards, advertising, and offering services without engaging in actual commercial activities, a GmbH would be less suitable for this purpose.

For all larger projects and for a limitation of liability, an LLC would be the better form. You can find a summary of the different legal forms in tabular form here.

Executive Management & Interim Managers

The position of a managing director in Germany is no different from that of a managing director in other European countries. Therefore, it is possible for both EU and non-EU citizens to hold this position. A managing director does not require a residence permit or visa if they are also a shareholder. However, a problem arises when opening a bank account before the company is established. A non-EU foreign national without a residence permit (for at least 6 months) or a settlement permit, or an EU citizen without a registered address in Germany, will not be able to open a business account with a German bank.

Since a bank account cannot be opened, the incorporation of a GmbH would be impossible. This is because, before notarizing the formation, a deposit account must be opened, onto which at least half of the share capital (EUR 12,500) must be deposited. The deposit receipt is submitted along with the notarized documents for the GmbH formation to the commercial register. Therefore, an interim manager (an EU citizen or a non-EU citizen with a residence or settlement permit) should be appointed during the formation process to open a bank account on behalf of the GmbH. This service is also available through JSE LEGAL. For more information on Interim Management, please read here.

LEGAL ADDRESS

A company, whether a sole proprietorship, GmbH, AG, or similar, requires a legal address that is reachable by the authorities. Therefore, when registering the company, a reliable and functional address should be selected through a reputable provider, especially if a proper office has not yet been rented. The company can also be registered at the managing director’s or shareholder’s residential address. This allows you to save costs on a legal address at the beginning.

Interim Manager

Management is a matter of trust.

Main legal structures

The choice of legal structure is directly related to the planned activities.

WORK PERMIN & VISA

In general, foreign employees are only allowed to work in Germany if they have a residence permit that specifies that employment is permitted, regardless of whether the branch is actually operational at the beginning or not. The simplest way to obtain a residence permit with the specified authorization to work is by obtaining the Blue Card for skilled workers. This requires a minimum annual gross salary of €

58,400 (as of July 2024). The Blue Card is initially issued for 2 years and allows multiple entries and exits.

The penalty for employing someone without a work permit could be very high and may result in the suspension of the branch’s operations, as well as the deportation of foreign employees and employers. A description of the requirements for applying for a Blue Card can be found here.

ACCOUNTING & TAXES

Accounting and tax matters must be clarified before the company is established. There is no obligation to hire an accountant or tax advisor, but regular tax returns must be filed. Therefore, it is important to find at least one tax advisor after the company is founded and operations have begun, who is willing to take you on as a client. However, it is not necessarily required to set up your own accounting system immediately, as the workload after incorporation is manageable, and having an in-house accounting team only becomes cost-effective once the company reaches a certain size.

OPENING BANK ACCOUNTS

Opening bank accounts, particularly for foreign shareholders, is a complex process and usually requires more effort than the registration of a GmbH. In this regard, choosing the right bank is one of the most important decisions when entering the market.